MONEY MANAGEMENT – Here are some of the best budget apps for the year 2024 that you must consider.

Money management is the process of overseeing, budgeting, saving, investing, and spending money wisely to achieve financial goals and ensure financial stability. It involves making decisions about how to earn, save, invest, and spend money effectively.

Creating and following a budget is the foundation of effective money management. A budget helps individuals or households track income and expenses, allocate funds for necessities, savings, debt repayment, and discretionary spending.

Saving money is essential for building financial security and achieving financial goals. Setting aside a portion of income regularly helps individuals establish emergency funds, cover unexpected expenses, and work towards long-term objectives such as homeownership, education, retirement, or travel.

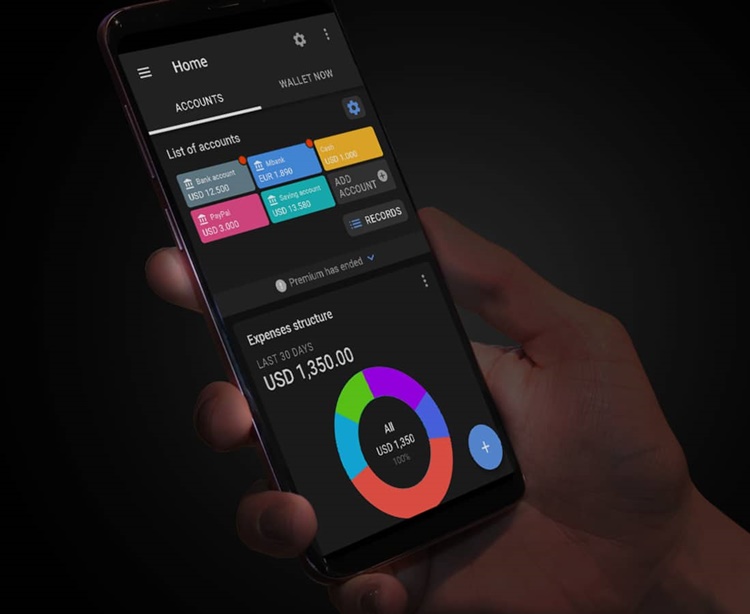

Nowadays, money management apps are digital tools designed to help individuals track income, expenses, savings, investments, and overall financial health conveniently and efficiently.

These apps typically offer features such as budgeting, expense tracking, bill payment reminders, goal setting, investment tracking, and financial reporting.

Here are some of the best money management apps for 2024:

Mint

Mint is a popular choice for its comprehensive features, including budget tracking, bill reminders, credit score monitoring, and investment tracking. It syncs with bank accounts, credit cards, and other financial accounts to provide a complete overview of finances in one place.

YNAB (You Need A Budget)

Focuses on zero-based budgeting, encouraging users to give every dollar a job. It offers real-time tracking, goal setting, and personalized budgeting tools to help users prioritize spending and achieve financial goals.

Personal Capital

Personal Capital is ideal for users interested in investment management and retirement planning. It provides tools for tracking investments, analyzing asset allocation, retirement planning, and net worth calculation.

PocketGuard

PocketGuard simplifies expense tracking and budgeting by categorizing transactions and providing insights into spending habits. It also offers bill tracking, subscription monitoring, and savings goal setting features.

EveryDollar

EveryDollar, created by financial expert Dave Ramsey, focuses on zero-based budgeting principles. It helps users allocate income to different spending categories and track expenses to stay within budget.

Goodbudget

Goodbudget follows the envelope system, allowing users to allocate money to virtual envelopes for various spending categories. It promotes conscious spending and staying within budget limits for each category.